In the years since the severe global financial crisis of 2008,1 macroprudential policies have attracted interest as a potential additional set of tools to complement ordinary monetary policy, a possible means of counteracting financial market excesses and subsequent crashes.

In the six years since my last report,2 members of the International Finance and Macroeconomics Program have written over 600 working papers. Many have been published subsequently in leading journals. There is not space here to summarize all or most of them. Instead, I will concentrate on recent research on international macroprudential regulation. All of the working papers in the IFM program can be found on the NBER's publications webpage using the "working papers by program" feature.

We have long had microprudential regulation of banks and securities markets. But macroprudential thinking begins with the observation that the whole of the financial system is more than the sum of the parts. A micro-prudential regulation might, for example, limit the loan-to-value ratio for individual mortgages or set capital minimums for individual lenders at levels that are figured by taking the probability of housing price fluctuations as exogenous. Thus it is a "partial equilibrium" approach. A macro-prudential approach recognizes that housing prices are endogenous, and that during a credit-fueled housing boom, the probability of a crash is greater and so regulations on individual borrowers and lenders may need to be set more stringently.

Financial regulators need to think about business cycle fluctuations, and macroeconomic policy-makers need to think about financial regulation. It is not just banks and private financial institutions that were led by a micro perspective into thinking that default probabilities were independent across households, and that therefore treated mortgage-backed securities as virtually riskless. Some regulatory agencies also neglected the correlation across borrowers and so underestimated the possibility that many mortgages could fail simultaneously in a housing downturn.

This survey of recent NBER research on international macroprudential policies is divided into four distinct areas: (1) national prudential policies that address macroeconomic issues in the sense of varying over the business cycle; (2) macroprudential regulation that focuses on the composition of debt, for example treating foreign debt as carrying an extra risk beyond that of domestic debt and perhaps restricting mortgage borrowing in foreign currency more than in domestic currency; (3) a precautionary approach to the national balance sheet with regard, in particular, to foreign exchange reserves; and (4) global liquidity conditions and coordination issues. This survey places some emphasis on findings from emerging markets.

1. Cross-country Differences in the Use of Macroprudential Policies

One root source of capital market imperfections is the need for borrowers to have collateral in order to prove their creditworthiness.3 A debtor who is up against a collateral constraint may be forced to sell assets ("fire sale"), driving down the market price and thereby putting other borrowers up against their own constraints. Javier Bianchi and Enrique Mendoza show how overborrowing carries a pecuniary externality because private agents do not internalize how the price of assets used for collateral responds to collective borrowing decisions.4 Their model suggests that financial innovation may have played a role in the financial crisis of 2008-09.5

Many observers warn of the moral hazard dangers of bailing out creditors or lenders in a financial crisis. But if the time-consistent system features government intervention during the deleveraging phase of the cycle, it is appropriate to take this into account beforehand. Restrictions or taxes on overborrowing during the boom phase of the cycle will reduce the likelihood or pay the costs of bailouts during the bust phase. In theory, taxes on debt and dividends that vary with the stage of the cycle can offset the overborrowing externality.6

Wall Street is connected to Main Street. Financial market imperfections can interact with the provisions of standard macro models in which labor markets and goods markets do not always clear. The collateral constraint acts as a financial accelerator, magnifying economic downturns. Monetary policy may not be adequate to combat the recession that results during the deleveraging phase, especially if the nominal interest rate cannot fall enough because of a liquidity trap, more specifically the zero lower bound.7 In this context, central banks may be able, in place of monetary policy, to use ex ante macroprudential policies such as debt limits and mandatory insurance requirements during the boom phase. These policies can offset the overborrowing externality.8

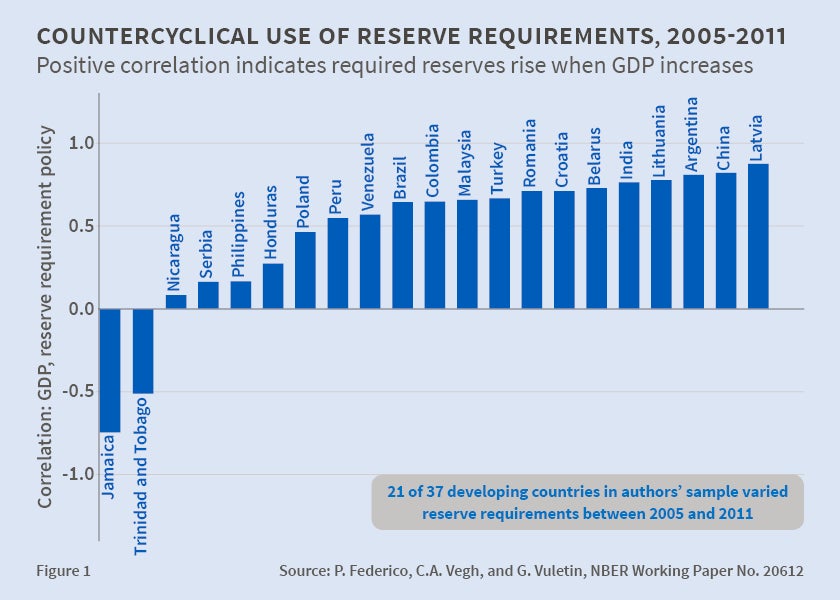

Financial market shocks can be transmitted to the real economy through the banking sector in particular.9 Standard bank regulations to reduce risk include10 capital requirements, a limit on leverage, dividend taxes, liquidity requirements,11 deposit insurance,12 stress tests,13 ongoing supervision of financial institutions,14 and minimum reserve requirements. Pablo Federico, Carlos Végh, and Guillermo Vuletin find that developing countries use reserve requirements countercyclically far more than advanced countries do (see Figure1), probably as a substitute for monetary policy which is diverted, for example, by the need to raise interest rates in recessions in order to defend the currency.15

Booms in real estate lending and house prices bubbles, which can originate in loose credit market conditions imported from abroad, materially heighten the risk of financial crises.16 Some countries have had success using regulations in the housing sector to discourage households from excessive mortgaging. The regulations include maximum ratios of debt service-to-income (DSTI) and loan-to-value (LTV). These become "macroprudential" when they are raised or lowered with the cycle.17

2. Macroprudential Regulation in Emerging Markets

Models of financial market imperfections, overborrowing, crises, and macroprudential regulation were considered appropriate for emerging markets18 long before the financial crisis of 2008 impelled most economists to contemplate them seriously for advanced countries. Some of the same lessons and models that international economists developed to explain the emerging markets' sudden stops of the 1990s, for example, could be applicable to Europe and the U.S. as well.19 Korea, in particular, has had some success with macroprudential measures that vary over the cycle.20

Regulation of Foreign Liabilities

In open economies, prudential regulation cannot be imposed domestically without regard to the international activities of financial institutions. In some cases, authorities may decide to treat foreign debt as carrying extra risk beyond that of domestic liabilities and may, for example, set higher reserve requirements for banks' foreign-currency deposits than for domestic deposits.

The tightening of capital requirements or other regulations on domestic banks in one country may cause a "leak" abroad, in the sense that some of the projects that might previously have been funded by domestic banks may now be financed from abroad.21 This suggests one justification for capital controls. Charles Engel, in a survey of macroprudential policy under high capital mobility, concludes that the leakage may justify international coordination of prudential policy, as under the Basel III agreement.22

Capital Flow Management Policies Include Macroprudential and Capital Controls

Although the theory of pecuniary externalities offers an explanation why financial markets do not always deliver the best outcomes and so why macroprudential regulation might be justified, a finer-grained analysis is needed if the conclusions are to be of practical use. What is different about the danger of overborrowing internationally as opposed to domestically? What is different about controls on international capital flows as opposed to domestic prudential regulation?

Macroprudential regulations and capital controls have come to be grouped together as Capital Flow Management policies, which have been found capable of reducing financial fragility.23 Distinguishing between macroprudential regulation (to limit leverage) and capital controls (to induce precautionary behavior) is potentially important. Anton Korinek has argued that the latter may be relevant only for those emerging market countries in which foreign-currency debt could render devaluation contractionary.24

Capital Controls with Fixed Exchange Rates

The theory of overborrowing as a pecuniary externality can help update the traditional point that capital controls can be used to insulate a pegged-currency country from external shocks.25 Controls can be used to reduce capital inflows in boom times and then reversed in bad times, like an umbrella that one uses only when it is raining. Another analogy, introduced by Michael Klein, is gates that can be opened or closed with the cycle (Brazil, South Korea) versus walls that are up permanently (China and India).26 Of course capital controls27 also have drawbacks, such as raising firms' cost of capital28 or lacking enforceability.29

Regulation to Influence Liability Composition

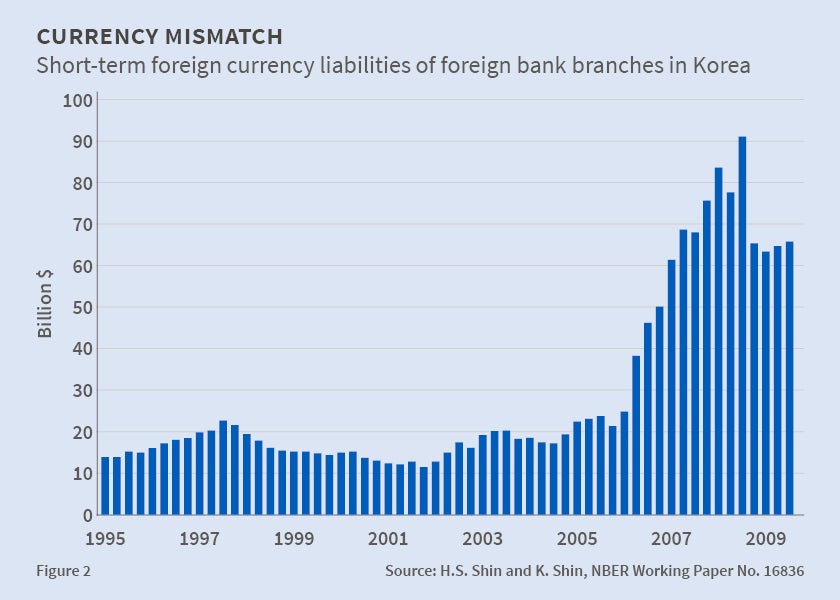

Some kinds of regulation aim to alter the composition, rather than the total level, of foreign liabilities. Capital controls may, for example, seek to alter the maturity composition of liabilities, reducing short-term capital flows that are prone to sudden reversals.30 Another concern is the currency composition of liabilities. Emerging market countries have in the past borrowed abroad primarily in dollars or other foreign currencies, rather than in their own currency. In the case of bank borrowing, such short-term foreign exchange liabilities are an example of the "non-core" funding sources (i.e., sources other than customer deposits) that banks increasingly turn to in a credit boom.31 In 1994-2001, a currency mismatch led to contractionary balance sheet effects when emerging market currencies were forced to devalue. After that experience, many countries sought to reduce this sort of vulnerability in their balance sheets by avoiding unhedged foreign currency liabilities.32 (Illustrated in Figure 2.)

One study of 51 emerging market economies over the period 1995–2008 suggests that some countries were able to use foreign currency-related prudential measures, domestic prudential measures, and financial-sector capital controls to reduce both the share of foreign exchange lending in total domestic bank credit and the share of portfolio debt in total external liabilities, which enhanced their resilience when the financial crisis hit in 2008–09.33

3. The Role of Reserves and the Precautionary Approach to the National Balance Sheet

A broader definition of macroprudential policies would include other efforts to strengthen the national balance sheet, such as increased holdings of foreign exchange reserves by the central bank, as precautions to reduce financial fragility.

Foreign Exchange Reserves

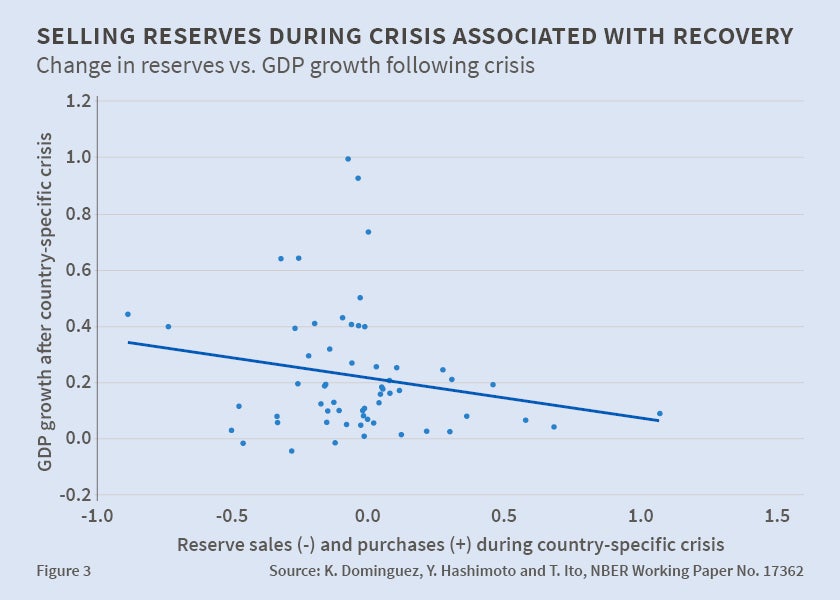

In the decade following the crises of the 1990s, central banks in emerging markets increased their foreign exchange reserves. One important reason was the precautionary motive: They believed it would help protect their countries against the worst effects of a financial or balance of payments crisis.34 This belief was tested in the global financial crisis, a common shock experienced by all countries. Some studies have found that countries holding a high level of foreign exchange reserves indeed tended to come through 2008–09 in better shape than others.35 (See Figure 3.) In particular, countries that had a high ratio of foreign exchange reserves to external borrowing were not hit as badly as those with a low ratio.36 Again in 2013, countries that had been holding more reserves seemed better able to withstand the shock of higher U.S. interest rates that was associated with suggestions of a less-expansionary monetary policy.37 Some other studies, however, have found less evidence of an effect.38

Alternatives also include Reserves and Appreciation

A complete set of alternative policies for managing a capital boom would include not just capital flow management policies but also conventional countercyclical macroeconomic actions such as tightening monetary policy, tightening fiscal policy,39 and allowing the currency to appreciate.40 How authorities manage a boom has a big influence on a country's vulnerability to subsequent adverse shocks.

4. Revisions in the Trilemma, Global Liquidity Conditions, and International Coordination

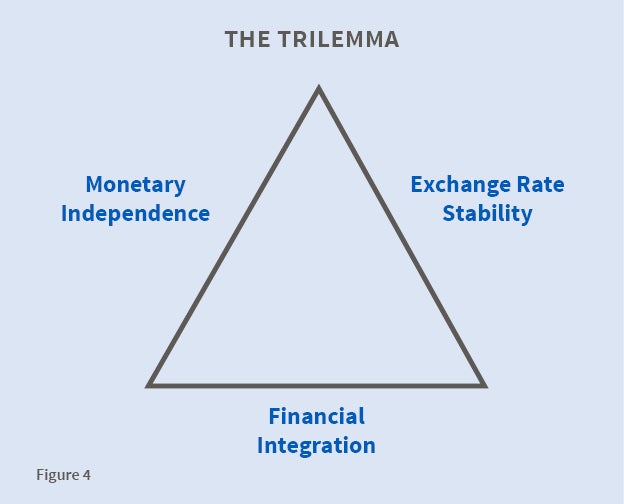

A long-standing principle in international macroeconomics, often associated with Robert Mundell, goes by the name of "the Impossible Trinity." Also called the "trilemma," the proposition states that even though a country might wish to have a fixed exchange rate, highly integrated financial markets, and the ability to set its own monetary policy, it cannot have all three. The logic is simple. If there are no differences between the domestic currency and foreign currencies and no barriers to the cross-border movement of capital, then the domestic interest rate is tied to the world interest rate, and so the country cannot set its own interest rate. (In terms of Figure 4, no point exists that is on all three sides of the triangle at once.)

This principle helps explain the travails of the eurozone. Member countries have found it difficult to live with central bank policies that are no longer tailored to their own economic circumstances.41 It also helps explain past crises such as currency crashes in emerging markets. When the Federal Reserve has raised interest rates, for example, it has sometimes forced Mexico to choose between an unwanted tightening of its own monetary conditions and an unwanted abandonment of the peso's peg to the dollar. This area of research is of particular interest at a time when quantitative easing by the Federal Reserve has come to an end and many observers are concerned that an expected increase in U.S. interest rates might once again reverse the flow of finance to emerging countries and trigger new crises.

Research questions abound. Does the trilemma mean that emerging markets should turn back the clock on capital controls? Does it mean that the movement toward floating exchange rates is the answer? Are intermediate regimes such as managed floating more workable than the corner choices?42 Do floating rates in fact insulate countries from foreign interest rates as advertised? Do macroprudential regulations offer a solution? Or is there a new need for international policy coordination across central banks so that the Federal Reserve, for example, would take emerging markets' interests into account when it sets interest rates?

Do Floating Rates Really Insulate?

In some theoretical models, capital market imperfections may prevent floating rates from performing the shock absorption role claimed in traditional macroeconomic analysis. Some, such as Emmanuel Farhi and Iván Werning, find that in such circumstances taxation of capital flows can be welfare-improving.43 Others find that capital controls are of limited help.44

U.S. Financial Conditions, Global Liquidity, and World Capital Flows

Hélène Rey finds that one global factor explains an important part of the cross-sectional variance of risky asset returns around the world. This time-varying global factor can be interpreted as the perceived importance of risk, as reflected in measures of volatility such as the VIX–often referred to as the "fear index".45 U.S. monetary policy is, in turn, a driver of this global factor and of international credit flows and leverage.46 As an example of "reach for yield," the carry trade entails short-term capital flows from low interest rate countries such as the U.S. to high interest rate countries such as the emerging markets.47

Traditional textbook theory under the trilemma says that floating exchange rates help insulate small countries against global financial factors such as U.S. monetary conditions, with each country choosing the monetary policy that suits its own economic conditions. But transmission of liquidity and risk effects may invalidate this insulation proposition.48 After all, many countries with floating exchange rates suffered effects of the U.S.-originated global financial crisis in 2008-09. Macroprudential regulations might reduce vulnerability to such liquidity and risk shocks. The issue is very relevant in 2015, as fears rise that coming increases in U.S. interest rates might trigger emerging market crises as in the past.

Interest Rates at the Zero Lower Bound

A particular version of the monetary independence problem may arise when countries are seeking to ease monetary policy in the presence of a liquidity trap. For example, interest rates may already be at the zero lower bound, as has been the case in Japan since the late 1990s and other major countries since 2009. If the textbook theory is right, currency depreciation offers another channel for monetary stimulus besides the interest rate. But if floating exchange rates in fact do not allow sufficient monetary independence, again there may be a role for capital flow management measures. Some argue that, in a global economy with open financial markets, the problem of the zero lower bound introduces a new dimension to the international policy trilemma.49

Central Bank Coordination

Another response to the problem of spillovers from U.S. monetary policy to emerging market countries is a call from emerging market leaders like Raghuram Rajan, Governor of the Reserve Bank of India, for the major central banks to coordinate monetary policy with an eye toward international repercussions. Of course the mandate of the Federal Reserve, and of other central banks, is to act to promote the best interest of its own economy.50 But that need not rule out taking into account international repercussions of monetary policy moves or coordinating with other countries.51 Macroprudential policies may themselves need to be coordinated internationally.52

About the Author(s)

Jeffrey Frankel is Harpel Professor of Capital Formation and Growth at Harvard University's Kennedy School. He directs the Program in International Finance and Macroeconomics at the National Bureau of Economic Research and is also a member of its Business Cycle Dating Committee, which officially declares the dates of U.S. recessions. Frankel was a senior staff economist at the President's Council of Economic Advisers in 1983-84, served as chief economist there in 1996-97, and was a Senate-confirmed appointee in 1997-99. Earlier in his career, he was professor of economics at the University of California, Berkeley, where he joined the faculty in 1979.

Frankel is a member of the Bellagio Group and advisory panels for the Federal Reserve Bank of New York and the Bureau of Economic Analysis. He was born in San Francisco, graduated from Swarthmore College, and received his Ph.D. in economics from MIT.