Amid calls for greater attention to the policies and market institutions that affect household financial choices, the NBER Household Finance Working Group was established in 2009 with support from the Alfred P. Sloan Foundation. It provides a forum for disseminating research and fostering collaboration among those working on household financial decision-making, the structure and operation of markets offering financial products targeted to consumers, and the regulatory policy issues that arise in these markets.

The activities of the working group have helped to define the field of household finance. This report, which summarizes research studies presented at group meetings over the last several years, illustrates several of the field's core areas of research. These papers represent only a small subset of the research that has been discussed at working group meetings.

Financial Education

A large and growing literature has documented widespread consumer behaviors, often labeled financial mistakes, which involve households paying more than they need to for some services, or purchasing services that do not appear to serve their needs. An oft-cited antidote to these "mistakes" is financial education. But initial research on financial education largely documented correlations rather than causal effects. More recent research takes seriously the problems of identification.

William L. Skimmyhorn uses administrative data matched with credit bureau records to evaluate the effects of a large natural experiment, a mandatory personal financial management course adopted by the U.S. Army in 2007–08 for all newly enlisted personnel.1 The paper exploits the staggered rollout of the program across military bases to rule out time effects as a factor that might confound the results. Soldiers who joined the Army subsequent to the course's introduction have retirement savings plan participation and contribution rates roughly double those of soldiers who enlisted just prior to introduction of the course. They also have lower credit card balances, auto loan balances, and unpaid debts.

Miriam Bruhn, Luciana de Souza Leão, Arianna Legovini, Rogelio Marchetti, and Bilal Zia evaluate a randomized controlled trial designed to provide evidence on the impact of a newly designed, comprehensive financial education program in Brazilian high schools.2 The 17-month program integrates financial education into the math, science, history, and language curriculum of almost 900 high schools and includes new textbooks and extensive teacher training. The program leads to improved levels of student financial proficiency, increased saving, and better budgeting behavior, but also results in higher use of expensive credit for consumer purchases. The program also has some positive spillover effects in the financial behaviors of students' parents.

Together, these two papers suggest that appropriately designed financial education programs can substantially affect household financial outcomes.

Financial Advice

Another antidote to consumer financial mistakes is the provision of financial advice. Understanding whether such advice improves outcomes is a recent, active area of ongoing research. One potential problem is that some advisers may have conflicts of interest due to the incentives built into their compensation. Two recent audit studies, employing actors posing as consumers seeking financial advice, shed light on the nature of these conflicts.

The first, by Santosh Anagol, Shawn Cole, and Shayak Sarkar, examines the quality of advice provided by life insurance agents in India.3 They find that agents maximize their own welfare by recommending products with high commissions, instead of less-expensive products that can deliver the same, or very similar, benefits. They also find that agents cater to the beliefs of uninformed consumers even when those beliefs are wrong, presumably because doing so increases the likelihood of retaining those customers. The second, by Sendhil Mullainathan, Markus Noeth, and Antoinette Schoar, examines the investment advice provided by financial advisers who interact with the broad population of retail investors — as distinguished from high net-worth households — in the United States.4 They examine a set of advisers who are paid based on the fees they generate, and they too find that advisers often reinforce the biases of potential clients when doing so is in the advisers' interests. For example, many advisers in their study recommended actively managed portfolios with higher fees and commissions for the adviser rather than lower-cost index funds with lower associated commissions.

Mark Egan, Gregor Matvos, and Amit Seru evaluate the prevalence of misconduct among financial advisers in the United States.5 Using data on customer filings and regulatory actions against U.S. broker-dealers over a 10-year period, they document that 7 percent of broker dealers have a record of misconduct, and that prior offenders are five times more likely to face new allegations of misconduct than the average adviser. They also evaluate the implications of misconduct. Half of the advisers accused of misconduct lose their jobs, although many are subsequently rehired by other firms. The firms that hire these previously dismissed advisers have higher firm-level rates of misconduct. Misconduct is also more likely in firms that primarily serve retail customers in counties with older, less-educated, higher-income populations. This leads to a segmented market in which some firms cater to unsophisticated consumers because they can get away with higher levels of misconduct, while others discipline misconduct to retain a reputation that will attract financially sophisticated consumers.

These findings raise the question of how investors assess the advice quality and trustworthiness of financial advisers. Julie R. Agnew, Hazel Bateman, Christine Eckert, Fedor Ishkhakov, Jordan Louviere, and Susan Thorp explore this question in a multi-round incentivized survey experiment in which subjects were given conflicting recommendations from two advisers regarding a financial choice.6 Subjects are more likely to follow advice that is not in their best interest in later rounds if they received advice that was in their interest in earlier rounds. They are more likely to follow advice if the adviser displays a credential, even though many cannot accurately assess whether a credential is legitimate or fake. They are also more likely to accept bad advice when the quality of the advice is more difficult to assess. These findings suggest that it may be relatively easy for ill-intentioned financial advisers to dupe unwitting clients.

Retirement Saving

One approach to increasing retirement savings that does not rely on either financial literacy or financial advice is automatic enrollment, which could be mandatory or allow an option to opt out of savings plan participation. There is compelling evidence that such an approach increases both savings plan participation and asset accumulation in the accounts into which individuals are automatically enrolled.7 One important question not answered in the early research on this topic is whether the savings generated are new savings, or whether they are offset by changes elsewhere on the household balance sheet. More recent research has tried to address this important question.

Using data from Denmark, Raj Chetty, John N. Friedman, Soren Leth-Petersen, Torben Nielsen, and Tore Olsen examine the impact of changes in compulsory pension plan contributions on total household savings.8 When individuals change jobs in Denmark, their new employer may have a compulsory pension plan contribution rate that is higher or lower than their previous employer. The researchers find that individuals offset only 20 percent of these compulsory saving changes by adjusting their savings elsewhere, both in the short- and longer term.

John Beshears, James J. Choi, David Laibson, Madrian, and Skimmyhorn examine another potential margin of adjustment: household debt.9 They study the impact of the adoption of automatic enrollment into the Thrift Savings Plan for U.S. Army civilian employees, and find that automatic enrollment increases savings while generating no statistically significant changes in credit card or other forms of non-collateralized debt at any time horizon studied. They do, however, find modest increases in auto loan and first-mortgage debt at horizons of two to four years. Because auto and mortgage debt originations coincide with asset purchases, it is unclear whether increases in these liabilities imply decreases in net worth.

Borrowing

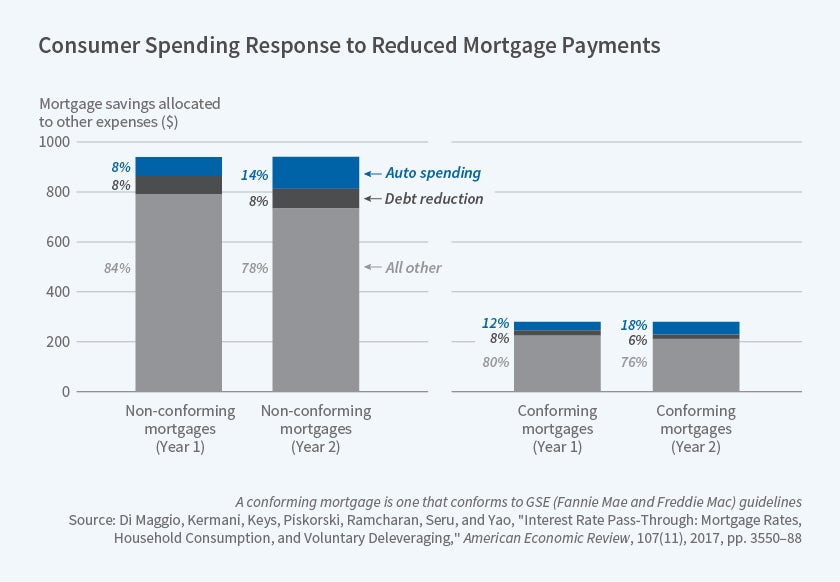

Linkages between different pieces of the household balance sheet have also been examined in the context of the large and plausibly unanticipated changes in consumers' monthly mortgage payments resulting from the large reduction in interest rates that occurred in the years following the global financial crisis. Using matched mortgage and credit bureau data, Marco Di Maggio, Amir Kermani, Benjamin J. Keys, Tomasz Piskorski, Rodney Ramcharan, Seru, and Vincent Yao show that, on average, consumers with nonconforming adjustable rate mortgages saw their monthly payments fall by $940, a decline of 53 percent. Those with conforming adjustable rate mortgages experienced a $280 average monthly reduction — 23 percent — when interest rates were reset.10 They then evaluate how consumers respond to these reductions.

Their findings, which are summarized in Figure 1, suggest that consumers increase automobile purchases when the mortgage load lightens. They measure this by the assumption of new auto debt, and find that this single source of additional consumption accounts for 8 to 18 percent of the liquidity generated by consumers' lower mortgage payments. This consumption response is larger for households that are likely more constrained, namely, those with higher loan-to-value ratios and lower incomes. Consumers also increase their voluntary prepayments of mortgage debt, which accounts for 6 to 8 percent of the additional liquidity. This deleveraging response is smaller for households that are more constrained. The reduction in mortgage payments also leads to a substantial decline in the mortgage default rate, consistent with the results of another study by Andreas Fuster and Paul S. Willen.11

What all this points to is that reductions in required mortgage payments affected aggregate economic outcomes. Areas with a higher concentration of adjustable rate mortgages saw a relative decrease in default rates for consumer debt, lower rates of house price decline, increases in auto sales, and relative improvements in employment in the non-tradable sector. These results highlight the importance of mortgage debt contract rigidity in the transmission of monetary policy to the real economy.

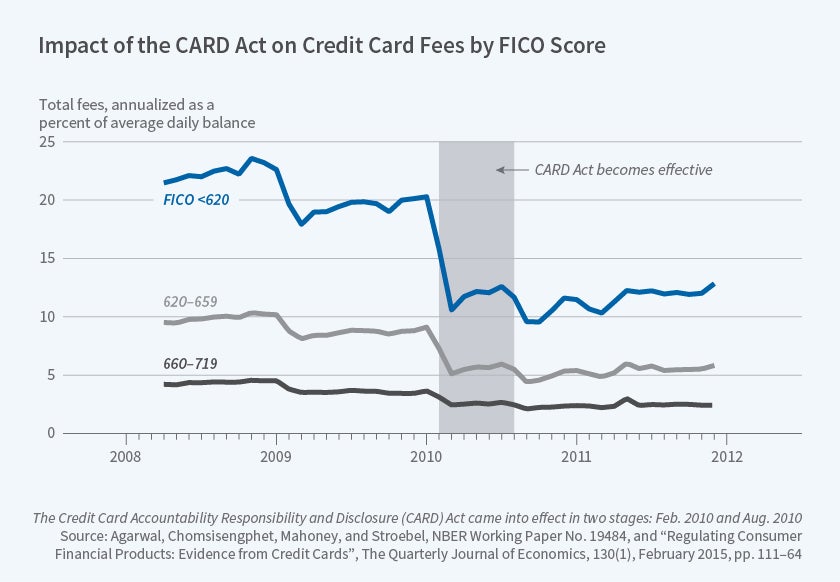

Credit cards are another important form of household debt, and the subject of several recent regulatory reforms in the United States. Sumit Agarwal, Souphala Chomsisengphet, Neale Mahoney, and Johannes Stroebel assess the impact of the 2009 Credit Card Accountability Responsibility and Disclosure (CARD) Act, which limited interest rate increases for credit cards and placed restrictions on non-interest fees for such things as exceeding the card's limit, paying late, and being inactive.12 Using data on 160 million credit card accounts from several of the country's largest credit card lenders, they compare outcomes for consumer cards, which were subject to the regulations, to those for small business cards, which were not. They find that the CARD Act reduced fees paid by consumers by $12 billion per year in aggregate, an amount equal to 1.6 percent of annualized average daily balances. Figure 2 shows that these benefits accrued disproportionately to consumers with low FICO scores who tend to pay higher fees. The researchers find no evidence of reduced credit volume or an offsetting increase in other fees charged by credit card issuers.

Social Insurance

Social insurance is an important source of financial protection for households in a variety of financial circumstances. Two recent studies examine the impact of a particularly important source of insurance — Medicaid — on the financial position of low-income households.

Tal Gross and Matthew Notowidigdo examine the effects of state Medicaid expansions between 1992 and 2004.13 They find that out-of-pocket medical costs are an important factor in roughly one-quarter of the personal bankruptcy filings of low-income households. As a result, a 10 percentage point increase in Medicaid eligibility, which by design reduces out-of-pocket medical costs, also reduces personal bankruptcy filings by 8 percent.

Kenneth Brevoort, Daniel Grodzicki, and Martin B. Hackmann examine the effects of the Medicaid expansion provision of the Affordable Care Act (ACA).14 They estimate that increased health insurance coverage has a number of beneficial effects on eligible households: a $3.4 billion reduction in unpaid medical bills sent to collection over a two-year period, higher credit scores, and better terms on the credit offered to households. Overall, they calculate that the indirect financial benefits of Medicaid in terms of better credit market outcomes are of a roughly similar magnitude to the direct reduction in out-of-pocket medical expenditures.

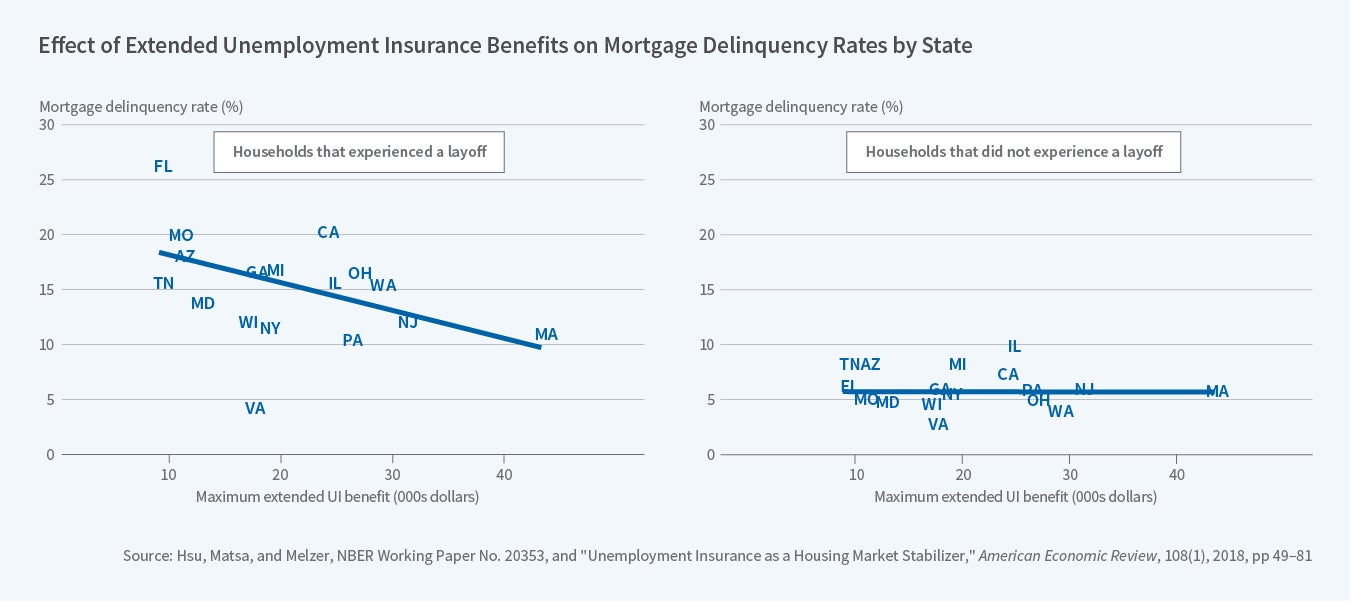

Joanna Hsu, David Matsa, and Brian Melzer examine the financial effects of another important form of social protection — unemployment insurance (UI).15 They exploit variation in the generosity of UI across states and over time to examine its impact on housing market outcomes for households that did and did not experience a layoff. They find that a $3,600 increase in the maximum annual benefit amount, equal to the cross-state standard deviation of benefits in 2010, reduces both mortgage delinquency and foreclosure rates by about 13 percent among those who experienced a layoff (see Figure 3). Using these estimates, they calculate that the UI expansions that took effect during the global financial crisis prevented 1.3 million foreclosures between 2008 and 2013, over 60 percent more than the number of foreclosures prevented by the Home Affordable Modification Program and the Home Affordable Refinance Program combined. UI also moderated the decline in house prices experienced in areas with rising unemployment. They conclude that UI acts as an automatic stabilizer for both aggregate consumption and for the housing market.

Bankruptcy is another important form of social protection. Felipe Severino and Meta Brown exploit variation in the personal bankruptcy exemption level across states and over time to examine how bankruptcy protection impacts credit market outcomes.16 They focus on a period before the passage of the federal Bankruptcy Abuse Prevention and Consumer Protection Act of 2005, which significantly changed the rules around filing for bankruptcy. From a theoretical standpoint, increasing the generosity of bankruptcy protection should increase borrowers' demand for credit but reduce lenders' willingness to supply it. The net impact is ambiguous. Analyzing a panel of credit bureau records, Severino and Brown find that more-generous bankruptcy protection laws don't affect the aggregate level of household debt, but do impact its composition. In particular, borrowers increase their holdings of unsecured debt, which is more easily discharged through bankruptcy, and pay more for this debt through higher interest rates.

Will Dobbie and Jae Song examine the impact of bankruptcy protection on a range of other important household financial outcomes.17 They examine households that filed for bankruptcy under Chapter 13 between 1992 and 2005 and exploit random assignment to judges who vary in their leniency in discharging debts through this form of bankruptcy. They find that being granted Chapter 13 bankruptcy protection increases annual earnings by approximately $5,500 (a 25 percent increase), increases the employment rate by 7 percentage points (an 8 percent increase), decreases five-year mortality by 1.2 percentage points (a 30 percent decrease), and decreases the five-year foreclosure rate by 19 percentage points.

Further analysis points to two mechanisms behind these results. First, the impact of being granted bankruptcy protection is larger in states in which creditors can garnish wages, suggesting that bankruptcy protection preserves incentives to work by reducing the overall effective "tax" on working. Second, bankruptcy protection appears to reduce the financial disruption associated with strategic moves to avoid creditors: Those granted bankruptcy protection are 25 percent more likely to continue working at the same job, and 15 percentage points more likely to continue working in the same state.

Sources and Implications of Firm-level Market Power

In addition to examining the behavior of individuals and households, recent research has examined several dimensions of firm- and market-level outcomes in household finance markets. One active area of research has focused on identifying the sources of market power — including advertising, the ability to shroud fees, search costs, and consumer inattention — and their costs to consumers.

Umit Gurun, Matvos, and Seru find that borrowers in areas where mortgage lenders advertise more pay higher mortgage interest rates conditional on borrower and contract characteristics, and that this effect is more pronounced for those who are less financially sophisticated.18 An analysis of advertising content shows that initial/introductory rates are frequently advertised in a salient fashion, while reset rates are not, a type of shrouded attribute.

Agarwal, Song, and Yao explore the effects of increased competition in the mortgage market generated by bank entry in the market following banking deregulation in the U.S.19 They find that banks facing more competitive settings tend to offer lower initial rates on adjustable-rate mortgages, but that most of the financial benefit to consumers from these lower rates is offset by higher reset rates.

On the investment side, Justine Hastings, Ali Hortacsu, and Chad Syverson use administrative data to analyze the pricing and sales force deployment decisions of firms that manage assets in Mexico's privatized social security system.20 They find that consumers exhibit less price sensitivity in areas where firms have a larger sales force, which then enables these firms to charge higher fees.

Anagol and Hugh Kim examine how the pricing structure of mutual funds in India enables firms to charge higher fees.21 They study a natural experiment, a 22-month period in which closed-end funds were allowed to charge a fee that was easily shrouded, while open-end funds were not. Fund entry during this period shifted dramatically from open- to closed-end funds, increasing overall fees paid by consumers.

Consumer search costs can also generate market power for financial services firms. Using data on millions of auto loans and loan applications from hundreds of financial institutions, Bronson Argyle, Taylor Nadauld, and Christopher Palmer document four empirical regularities that suggest that search costs impede market efficiency.22 First, there is significant dispersion in auto loan interest rates across institutions for the same type of loan, and most borrowers could access cheaper credit if they queried only two additional financial institutions. Second, search is costly, and borrowers are more likely to search in areas where search costs, as measured by the number of financial institutions within a 20-mile radius, are low. Third, there are large interest rate discontinuities at various FICO score thresholds, and significant variation across firms in the relationship between interest rates and FICO score; on average, borrowers with FICO scores just above an institution's FICO score threshold are offered loans with an interest rate 1.5 percentage points lower than borrowers with scores just below the threshold, even though there are no differences in subsequent loan performance between borrowers on either side of these thresholds. Finally, consumer purchasing and financing decisions are distorted by these discontinuities; buyers with FICO scores just below a threshold purchase older, less-expensive cars to offset the higher interest rate being paid, even though many could find a lower rate elsewhere if they shopped around.

About the Author(s)

Brigitte C. Madrian is the Dean of, and Marriott Distinguished Professor at, Brigham Young University's Marriott School of Business. She holds a joint appointment in the Department of Finance and the George W. Romney Institute of Public Service and Ethics. An NBER research associate, she has served as a co-director of the Household Finance Working Group from 2010–18.

Stephen P. Zeldes is the Benjamin M. Rosen Professor of Economics and Finance at Columbia University's Graduate School of Business, an NBER research associate, and co-director of the Household Finance Working Group since 2013.